How Average Car Insurance Cost For 17-year-olds - Insuraviz can Save You Time, Stress, and Money.

If you don't have ridesharing insurance as well as you're in a mishap, you could be responsible for all the damages-your personal insurance policy likely will not cover you. Just How University Students Can Get

A Discount On Discount Rate InsuranceAuto Insurance Policy of the hardest parts about components regarding insurance cars and truck insurance coverage choices the discounts that price cuts available to readily available. automobile. Is Switching Over Vehicle Insurance Well Worth It?

Another point that can make switching cars and truck insurance coverage worth it is combining it with renters insurance coverage. If you obtain a car insurance coverage as well as occupants insurance policy at.

affordable auto insurance cheap car insurance prices insurance affordable

affordable auto insurance cheap car insurance prices insurance affordable

the same companyExact same business renters insurance occupants be free(complimentary you can view it see a significant discount considerable your car insurance). Average Auto Insurance In Ontario By Month, Age As Well As Gender Wondering how much your auto insurance will cost in Ontario?

Once you get to a specific age, you could see prices begin enhancing again. They tend to drive much more, are most likely to be involved in mishaps, as well as take part in riskier driving practices. Males pay greater than females. To illustrate this factor we sourced data from our quoter as well as contrasted men as well as ladies in a collection of age classifications (insure). We then contrasted them to the overall standard for all drivers. People with a G2 licence will certainly pay greater than an individual with a G licence. As you advance via the licensing system, the quantity will lower. Bear in mind that G1 vehicle drivers can not be listed as the primary vehicle driver on a policy. However a policy with a G1 vehicle driver noted will cause a rate boost. This can be pricey since you are not completely certified.

Statistically, you are a better risk to entering a crash or suing. To save cash, you can get detailed on a moms and dads or guardians plan as a periodic vehicle driver. It will increase the costs, however not as high as if you got a different plan.

No-fault states include: What Various other Variables Influence Vehicle Insurance Coverage Fees? Your age and also your house state aren't the only things that affect your rates. Insurance providers make use of a selection of factors to establish the price of your premiums. Right here are several of the most crucial ones: If you have a tidy driving record, you'll discover a lot better prices than if you've had any recent accidents or web traffic infractions like speeding tickets.

Not known Details About Safeco Insurance - Quote Car Insurance, Home Insurance ...

Others supply usage-based insurance coverage that might conserve you cash. If your cars and truck is one that has a chance of being taken, you might have to pay even more for insurance policy.

However in others, having poor credit report can cause the cost of your insurance costs to increase dramatically. Not every state allows insurance companies to use the gender listed on your vehicle driver's permit as an establishing consider your costs. Yet in ones that do, female motorists generally pay a little less for insurance coverage than male chauffeurs (auto).

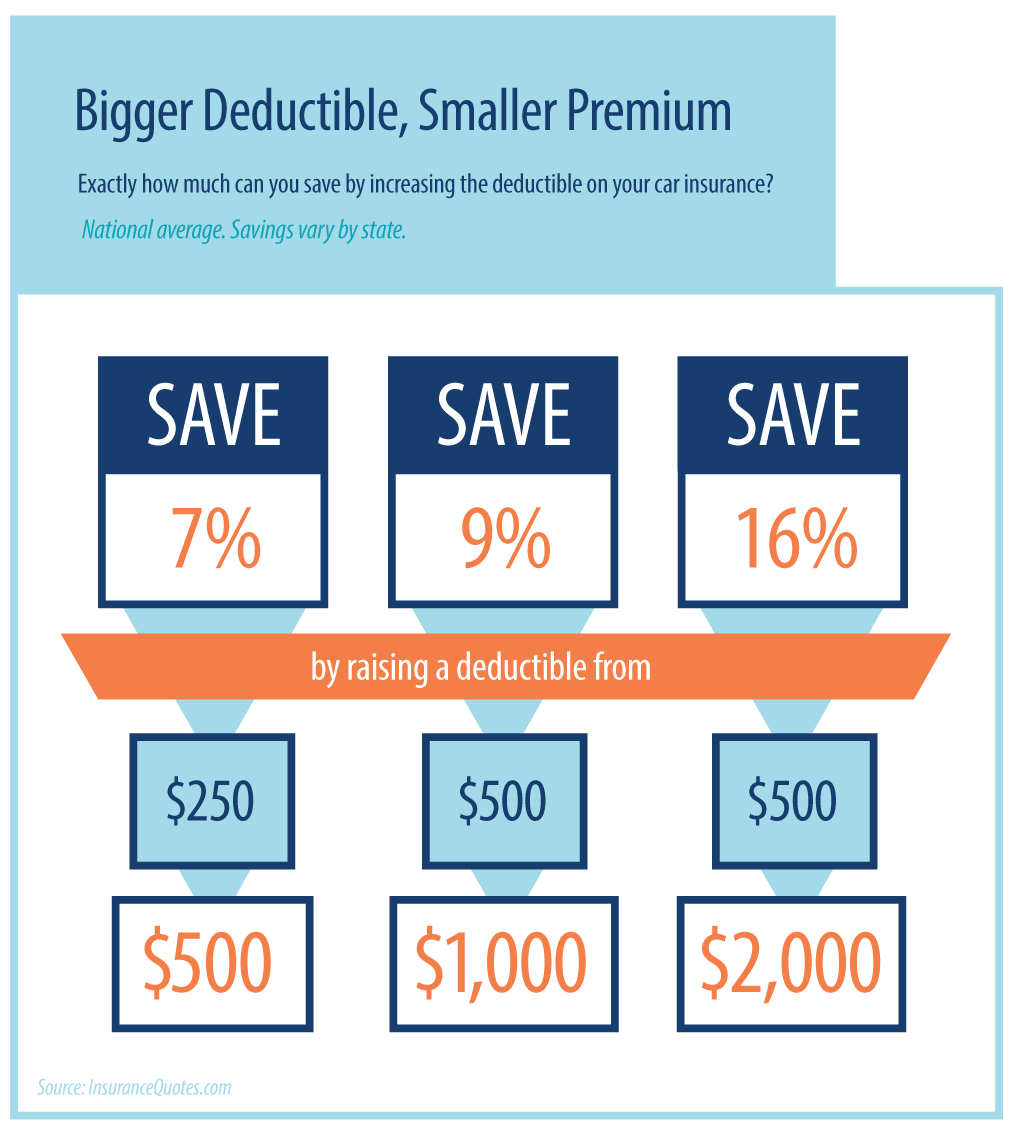

Policies that just satisfy state minimum insurance coverage needs will be the most inexpensive. Added insurance coverage will cost even more. Why Do Automobile Insurance Policy Rates Change? Checking out average car insurance policy prices by age and state makes you ask yourself, what else affects rates? The solution is that car insurance coverage prices can change for numerous factors.

An at-fault mishap can increase your rate as high as half over the following 3 years. If you were convicted of a DUI or perpetrated a hit-and-run, your rates will certainly go up much more. Nevertheless, you do not need to remain in an accident to experience rising prices. In general, vehicle insurance often tends to obtain more pricey as time goes on - car insured.

There are a number of other discounts that you could be able to capitalize on right now. Below are a few of them: Numerous firms provide you the most significant price cut for having a great driving history. Additionally called packing, you can get lower prices for holding more than one insurance policy with the same business.

House owner: If you have a home, you might obtain a house owner discount from a variety of carriers. Get a discount for sticking to the same firm for numerous years. Below's a key: You can always compare prices each term to see if you're getting the most effective rate, despite having your commitment price cut.

Tesla Says It Can Lower Insurance Costs & Make Driving Safer - Truths

Nonetheless, some can also elevate your prices if it ends up you're not a good vehicle driver. Some firms give you a price cut for having a good credit report. When searching for a quote, it's a good concept to call the insurance firm and also ask if there are anymore price cuts that relate to you.

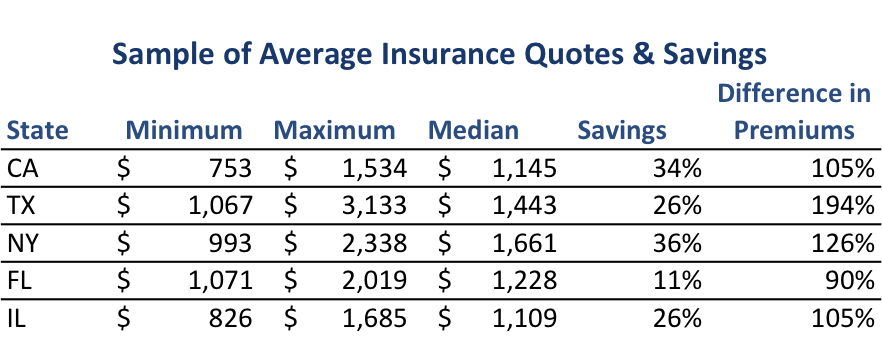

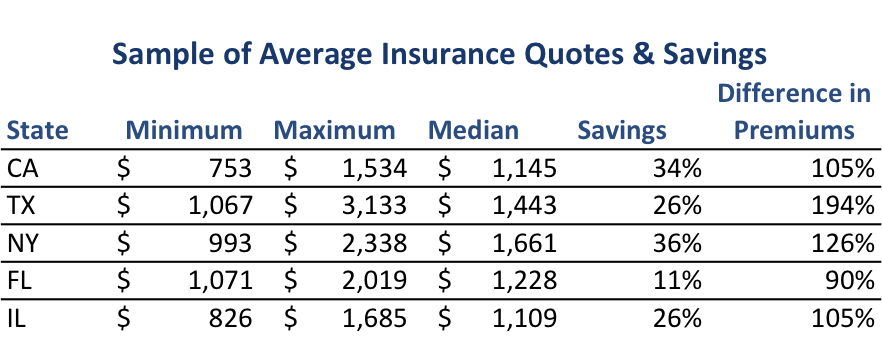

Typically, the cost for a full-coverage plan can set you back from $1300 in Maine to $8700 in Michigan. It can likewise vary within a state according to run the risk of variables in particular places. If you live or keep your cars and truck in an area that is regarded "high risk," whether it is because of regular collisions, criminal activity, or weather condition conditions, you might have a higher insurance policy price than a motorist with a comparable profile in a different location - vehicle insurance.

Minimum protection is the least costly plan you can get for your cars and truck, however it only covers the minimal demands by legislation from the state. With full insurance coverage, you have comprehensive as well as collision insurance coverage in enhancement to the minimum coverage. This option is much more pricey, it comes with more protection for your automobile.

Age is utilized to indicate just how much risk a motorist is to the insurer. Youthful or inexperienced vehicle drivers are a higher threat for the insurer, which is why they have higher insurance costs. As soon as vehicle drivers are 30 or older, automobile insurance coverage premiums are affected by sex - cheap. Young male motorists may have a premium that's 10 percent more than that of a young female driver.

In the states that enable gender-based prices, the distinction in premiums in between men and females is much less than 1 percent. The six-month typical vehicle insurance coverage premiums by gender are: Male: $734.

car trucks affordable car insurance

car trucks affordable car insurance

No-fault states include: What Other Elements Influence Automobile Insurance Policy Rates? Your age as well as your house state aren't the only points that impact your rates. Insurance companies utilize a range of factors to establish the price of your costs. Here are some of one of the most vital ones: If you have a tidy driving record, you'll discover far better rates than if you've had any kind of recent accidents or website traffic offenses like speeding tickets.

The Single Strategy To Use For Average Car Insurance Rates By Age And State (May 2022)

Some insurance firms might provide reduced rates if you don't use your auto a lot. Others supply usage-based insurance policy that may conserve you cash. Insurers factor the likelihood of a lorry being swiped or harmed in addition to the expense of that vehicle right into your costs. If your auto is one that has a likelihood of being taken, you may need to pay even more for insurance.

cheapest cheap insurance insurance company cheaper car insurance

cheapest cheap insurance insurance company cheaper car insurance

Yet in others, having negative debt can trigger the price of your insurance coverage costs to rise dramatically. Not every state permits insurance firms to make use of the gender detailed on your driver's certificate as an identifying consider your premiums. In ones that do, women vehicle drivers commonly pay a little much less for insurance coverage than male drivers.

Policies that just fulfill state minimum coverage needs will certainly be the cheapest - cheaper car. Extra insurance coverage will set you back even more. Why Do Automobile Insurance Rates Change? Taking a look at typical automobile insurance coverage prices by age and also state makes you wonder, what else impacts rates? The answer is that auto insurance coverage prices can alter for lots of reasons.

An at-fault crash can raise your price as much Find out more as 50 percent over the next three years. Overall, auto insurance policy often tends to get much more pricey as time goes on.

The good news is, there are a variety of various other price cuts that you could be able to profit from right now. Right here are a few of them: Numerous companies offer you the largest price cut for having an excellent driving history. Also called bundling, you can get lower rates for holding greater than one insurance plan with the exact same company (prices).

Property owner: If you have a residence, you could obtain a homeowner price cut from a variety of providers. insurance. Obtain a price cut for sticking with the exact same firm for several years. Here's a trick: You can constantly contrast rates each term to see if you're getting the best cost, despite your commitment discount rate.

Facts About How To Save On Monthly Bills As Prices Keep Rising Uncovered

Some can additionally increase your prices if it transforms out you're not an excellent vehicle driver. Some business offer you a price cut for having an excellent credit history. auto insurance. When looking for a quote, it's a good idea to call the insurance policy firm and ask if there are any type of more price cuts that apply to you.

It can also differ within a state according to risk variables in particular places., you might have a higher insurance rate than a chauffeur with a similar account in a various area.

Minimum insurance coverage is the least costly policy you can obtain for your car, however it only covers the minimal needs by law from the state. With full protection, you have extensive and also accident insurance coverage along with the minimum protection - automobile. This option is much more expensive, it comes with even more defense for your automobile.

Youthful or unskilled motorists are a greater risk for the insurance coverage business, which is why they have higher insurance coverage costs. When motorists are 30 or older, car insurance policy costs are influenced by gender.

cars cheapest auto insurance insurance car insurance

cars cheapest auto insurance insurance car insurance

https://www.youtube.com/embed/I4ArgsnpYCw

In the states that allow gender-based rates, the distinction in costs between males and females is less than 1 percent. The six-month typical vehicle insurance premiums by gender are: Man: $734.