My cheap car insurance online blog 2914

4 Easy Facts About Free Car Insurance Quote - Save On Auto Insurance - State ... Explained

Insurance can be overwhelming, and we don't want you to feel that way. We're here to assist you as you make the choices for your special way of life and financial resources.

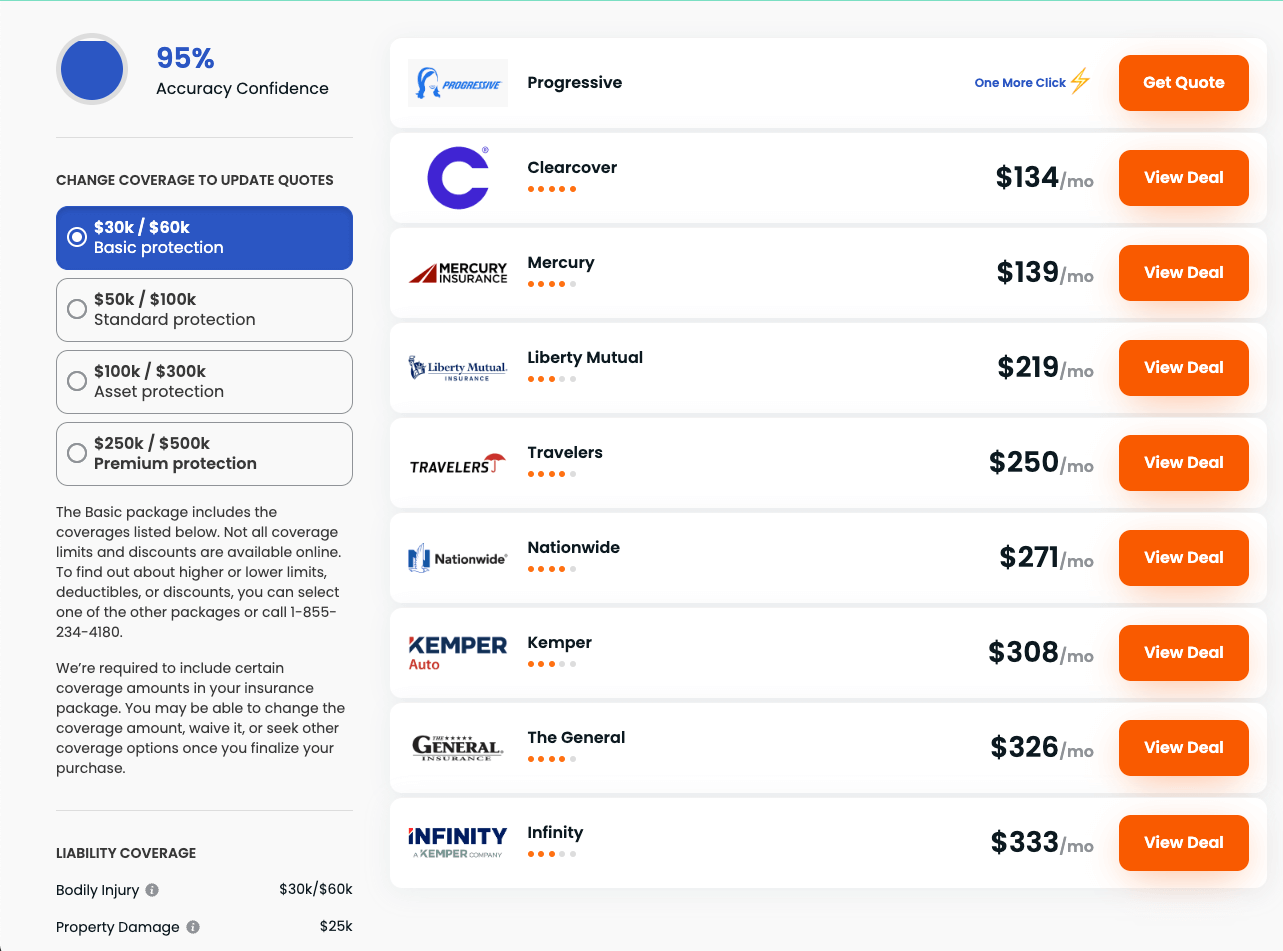

Get a cars and truck insurance coverage quote from The General by sending your postal code and some other information about any insurance exclusions, credit history, and liability. Insurance coverage companies check your ZIP Code for the variety of mishaps in the location. If you live in a place with a high mishap rate, generally city locations, anticipate to pay more for auto insurance coverage than somebody living in a light traffic area.

Always inform the truth about any traffic infractions you have actually received, due to the fact that the insurer will learn, and it will affect your premiums. Some insurance provider will not accept you if you did not have at least 6 months of prior cars and truck insurance protection, but that's not the case with The General.

Insurer supplement that details by gathering big quantities of data from client claims. Much safer lorries are often less costly to insure, and insurers frequently provide discount rates to clients driving safer automobiles. Some insurers increase premiums for cars that have poor safety records and are more susceptible to damage or resident injury.

The longer an insurer insures a type or design of car, the more information it needs to determine reasonable rates. If the vehicle has actually developed a strong track record over a number of years, odds are it will insure at an affordable rate, and stay stable with time (cheapest auto insurance). On the other hand, lorries with poor security history or those that are a favorite target for burglars will be costlier to insure.

Insurance coverage business have actually discovered that previous efficiency frequently does foretell future results. If you've had speeding tickets or mishaps, or other violations within the last few years, your automobile insurance rate might be greater than if you have a spotless driving record.

It simply makes sense, the more time on the roadway increases the opportunities of being included in a crash or sustaining damage to your automobile (car insured). Size matters, You may believe smaller cars and truck, smaller insurance premium.

Cheapest Car Insurance Companies 2021 - Reviews' Cheap List Can Be Fun For Everyone

Anti-theft gadgets, If your cars and truck has an alarm, a tracking device to help authorities recover it, or another theft deterrent, it's less appealing to thieves, and more economical to guarantee, too - insure. Your credit rating, Research study has revealed that good credit is linked to good driving and vice versa. Certain credit details can be predictive of future insurance coverage claims.

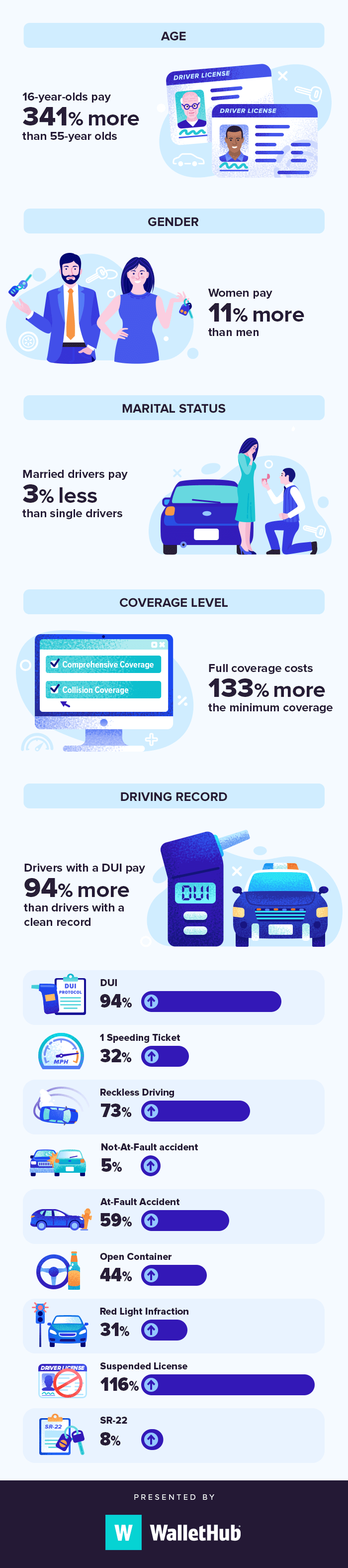

The bottom line: Excellent credit can have a positive impact on the cost of your cars and truck insurance - automobile. Your age, sex, gender and marital status, Crash rates are greater for all chauffeurs under age 25, specifically single males. Insurance rates in the majority of states show these distinctions. If you're a student, you may likewise be in line for a discount.

Where you live, Normally, due to greater rates of vandalism, theft, and crashes, metropolitan drivers pay more for automobile insurance than do those in towns or rural areas. You likely can't quickly alter where you live, however if you do reside in a high insurance coverage area make sure to pay close attention to the other elements that you can control.

By doing some research upfront about potential auto insurance rates, you can make a notified decision to make sure you have the right automobile at the best rate of owning it. See if ERIE can Deal a Cheaper Auto Insurance Rate, Ready to find out more about budget-friendly car insurance from ERIE? Here's where rubber truly fulfills the road plug the device into your car and it will track your driving routines, such as tough braking, speed and so forth.

Where you keep your car - Rates are determined to some degree by the area in which you live and park your vehicle - vehicle. The number of drivers on your policy If you add someone to your policy, your rate will increase, especially if that "somebody" is a new teen driver.

And with costing United States families and, it's more crucial than ever to find. One such method to conserve is to discover a provider with cheaper rates than what you presently have.

Some Known Questions About 5 Cheapest Car Insurance Companies In The U.s. (2022).

And while economical policies exist, it is essential to stabilize cost savings with appropriate coverage. If you get into an accident, for instance, you may end up paying more than you would have with much better, more expensive coverage. That said, there are cost effective alternatives out there with excellent protection at low rates.

Best inexpensive vehicle insurance coverage business Geico's advertising existence has actually made it one of the most recognizable brand names in automobile insurance coverage, and this insurance provider's prices and consumer service have made it one of the most beloved (trucks). Geico notoriously tells chauffeurs that they could save 15% or more by switching to the provider, however how does it offer such cost savings?

The General acknowledges that not every driver can boast the cleanest record, which errors-- such as accidents and driving violations-- occur behind the wheel. Still, the company ventures to offer sensible rates to motorists who may fall under the "nonstandard" label. It's also worth noting that insurance acquired through The General is financed by a variety of business that have been acknowledged by AM Finest with an "A" score, while The General itself has actually gotten an A- (excellent) rating - car.

If you can work with an insurer you currently use for other insurance protection, or an insurer that provides unique advantages to workers at your workplace, you can possibly save even more money on your car insurance coverage policy. You might be able to save money on your insurance premium by adjusting your protection or deductibles, but it may be beneficial to speak with an agent before making changes so that you better understand how your protection will operate in the occasion of an accident.

What identifies your car insurance coverage rates? Aside from diverse rates from insurance service providers, many factors influence the cost of your vehicle insurance, consisting of: Your age (in all states except Hawaii)Driving history, Credit rating (in some states)The quantity of protection you seek How can I reduce my insurance rates? Discovering an auto insurer that can conserve you cash is essential, but there are things you can do by yourself to guarantee you save cash on vehicle insurance. cheaper.

However, we might receive compensation when you click links to services or products used by our partners.

Save Cash with Inexpensive Car Insurance coverage Are you trying to find low-cost auto insurance however anxious about sacrificing quality and service in favor of a more budget friendly rate? GEICO has you covered. The word "low-cost" may be frightening when it concerns a vehicle insurance coverage, but it doesn't have to be in this manner - cheaper cars.

9 Simple Techniques For Cheap Car Insurance: Affordable Auto Insurance

It's cost effective. All while providing you with 24/7 client service and top-of-the-line insurance coverage for your lorry (automobile). Here at GEICO, quality does not fall by the wayside when it comes to providing customers with affordable automobile insurance and excellent client service.

Exist risks to getting low-cost car insurance? Inexpensive rates need to not imply you have to choose restricted policy protection options, high deductibles, poor client service, and an absence of essential safety functions like emergency roadside service. Things are various with GEICO, where cheap car insurance does not change the remarkable service, features, and coverage alternatives that our vehicle insurance policyholders receive - credit score.

GEICO policyholders are surrounded by money-saving opportunities that can make their cars and truck insurance rates more cost effective.: By switching to GEICO, students might conserve $200 on an automobile insurance policy. We work hard to make sure "low-cost" only explains your cars and truck insurance coverage rates and not the quality of service or your experience as an insurance policy holder (affordable car insurance).

At the end of 2021, many automobile insurance companies received approval to trek their rates in different states and premiums are anticipated to keep going up this year. And with costing US households and, it's more essential than ever to discover. One such way to save is to discover a carrier with less expensive rates than what you presently have.

And while economical policies exist, it is very important to stabilize cost savings with adequate coverage. If you enter an accident, for instance, you may end up paying more than you would have with better, more costly coverage. That stated, there are affordable choices out there with great coverage at low rates.

Finest inexpensive automobile insurance coverage business Geico's advertising existence has actually made it one of the most identifiable brand names in auto insurance coverage, and this insurance service provider's prices and customer service have actually made it one of the most beloved. Geico famously tells drivers that they could conserve 15% or more by switching to the provider, however how does it supply such cost savings?

9 Easy Facts About Direct Auto Insurance Explained

The General acknowledges that not every motorist can boast the cleanest record, and that errors-- such as accidents and driving offenses-- take place behind the wheel. Still, the business ventures to offer affordable rates to chauffeurs who might fall under the "nonstandard" label. It's likewise worth keeping in mind that insurance gotten through The General is underwritten by a variety of business that have been acknowledged by AM Best with an "A" rating, while The General itself has actually gotten an A- (excellent) rating.

If you can deal with an insurance company you already utilize for other insurance coverage, or an insurance provider that uses special advantages to staff members at your office, you can potentially save even more cash on your vehicle insurance plan. You may have the ability to save money on your insurance coverage premium by adjusting your coverage or deductibles, but it might be helpful to speak with an agent before making modifications so that you better comprehend how your coverage will operate in the occasion of an accident - cheaper auto insurance.

What determines your vehicle insurance coverage rates? Aside from diverse prices from insurance coverage providers, many factors affect the expense of your vehicle insurance, consisting of: Your age (in all states except Hawaii)Driving history, Credit rating (in some states)The amount of protection you seek How can I lower my insurance coverage rates? Discovering a car insurance company that can save you cash is very important, but there are things you can do on your own to guarantee you save money on automobile insurance coverage. trucks.

We may receive settlement when you click on links to items or services used by our partners.

Conserve Money with Cheap Automobile Insurance Are you searching for low-cost vehicle insurance however concerned about compromising quality and service in favor of a more budget-friendly rate? GEICO has you covered. The word "cheap" may be scary when it pertains to an auto insurance coverage policy, but it doesn't need to be by doing this.

It's inexpensive. It's good for your spending plan. All while supplying you with 24/7 client service and state-of-the-art insurance for your automobile. Here at GEICO, quality doesn't fall by the wayside when it comes to offering clients with budget friendly automobile insurance coverage and great client service. Get a totally free automobile insurance quote to learn how much you could save.

Exist risks to getting cheap cars and truck insurance coverage? Inexpensive rates must not mean you have to opt for limited policy protection alternatives, high deductibles, poor client service, and an absence of essential safety functions like emergency roadside service - car insured. Things are various with GEICO, where low-cost vehicle insurance does not alter the extraordinary service, features, and coverage choices that our automobile insurance coverage policyholders receive.

The Best Strategy To Use For Cheap Car Insurance - Affordable Auto Coverage From Erie ...

Bam! You're that much closer to signing up with the many who've saved hundreds on their cars and truck insurance. Now, let's talk about discount rates. GEICO policyholders are surrounded by money-saving opportunities that can make their vehicle insurance coverage rates more budget-friendly. Here are a few of them: Subscription Discount rates: If you become part of among the numerous expert and alumni companies that have actually teamed up with GEICO, you could conserve with a special discount rate.

https://www.youtube.com/embed/vHM0ILISzL4

Student Discount rates: By switching to GEICO, students might save $200 on a vehicle insurance coverage. Economical automobile insurance coverage actually is that simple. With GEICO, you don't have to jeopardize quality for an inexpensive car insurance plan. We strive to ensure "inexpensive" just explains your cars and truck insurance rates and not the quality of service or your experience as an insurance policy holder.

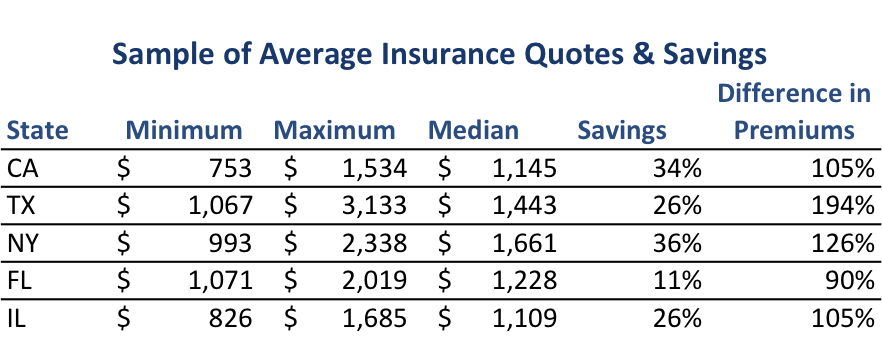

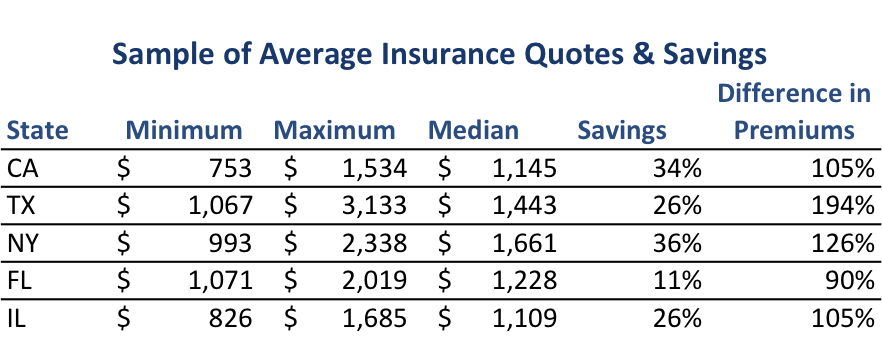

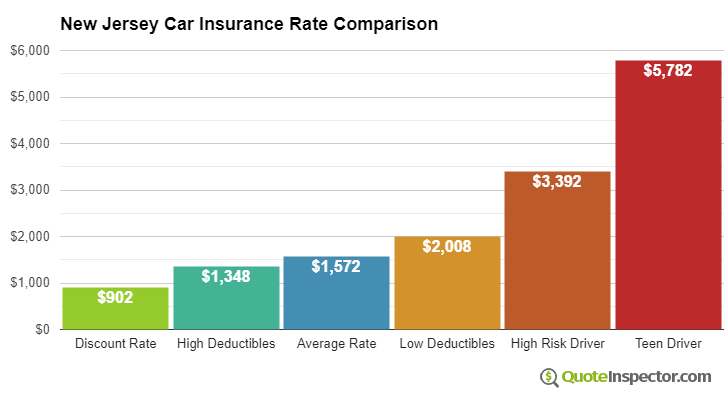

Top Guidelines Of Car Insurance Rates By State For 2021 - Coverage.com

You might obtain a price cut for obtaining various sorts of insurance coverage via your car insurance policy service provider, such as house or rental insurance coverage (prices). Ask an agent what various other insurance coverage is offered as well as whether you 'd obtain a price cut for bundling the protection.

A car insurance coverage plan can include numerous different type of protection - auto. Your independent insurance policy representative will give professional recommendations on the type and also quantity of cars and truck insurance policy coverage you ought to have to satisfy your private needs as well as abide by the regulations of your state. Below are the primary kinds of coverage that your policy might include: The minimal protection for physical injury differs by state and may be as low as $10,000 per individual or $20,000 per mishap - insurance affordable.

car insurance car insured cheaper cars vehicle insurance

car insurance car insured cheaper cars vehicle insurance

If you harm a person with your cars and truck, you can be filed a claim against for a lot of money (auto insurance). The amount of Responsibility coverage you lug should be high enough to protect your assets in the occasion of a crash. Many professionals recommend a restriction of at the very least $100,000/$300,000, however that might not be enough.

If you have a million-dollar residence, you might lose it in a suit if your insurance policy protection is not enough. You can get added protection with a Personal Umbrella or Personal Excess Obligation policy. The better the value of your assets, the a lot more you stand to shed, so you require to buy responsibility insurance coverage appropriate to the value of your possessions.

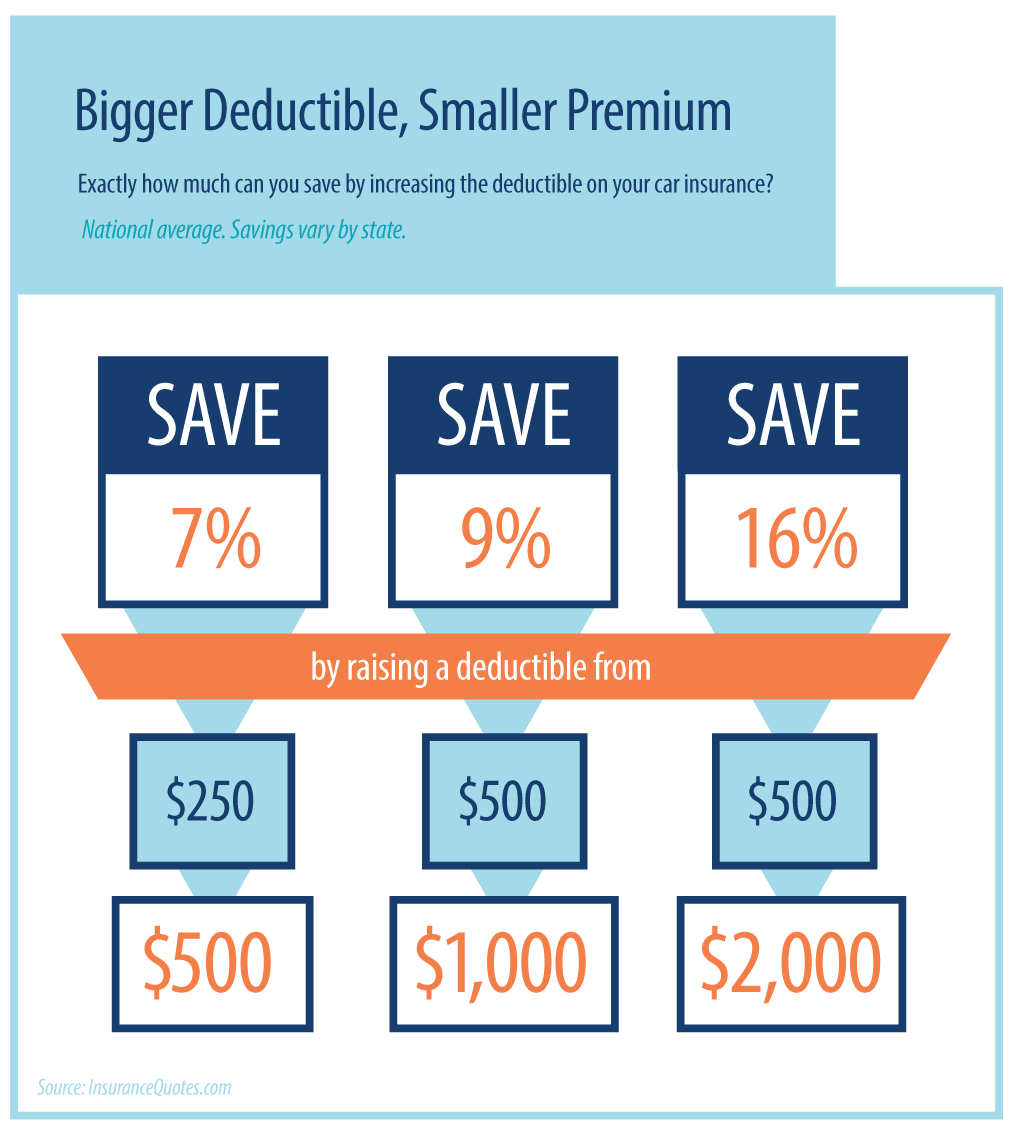

You don't have to determine just how much to acquire that depends upon the vehicle(s) you insure. However you do require to decide whether to purchase it and how huge a deductible to take. The higher the deductible, the lower your costs will certainly be. cars. Deductibles generally vary from $250 to $1,000.

How 10 Cheapest U.s. States To Buy Auto Insurance - Cnbc can Save You Time, Stress, and Money.

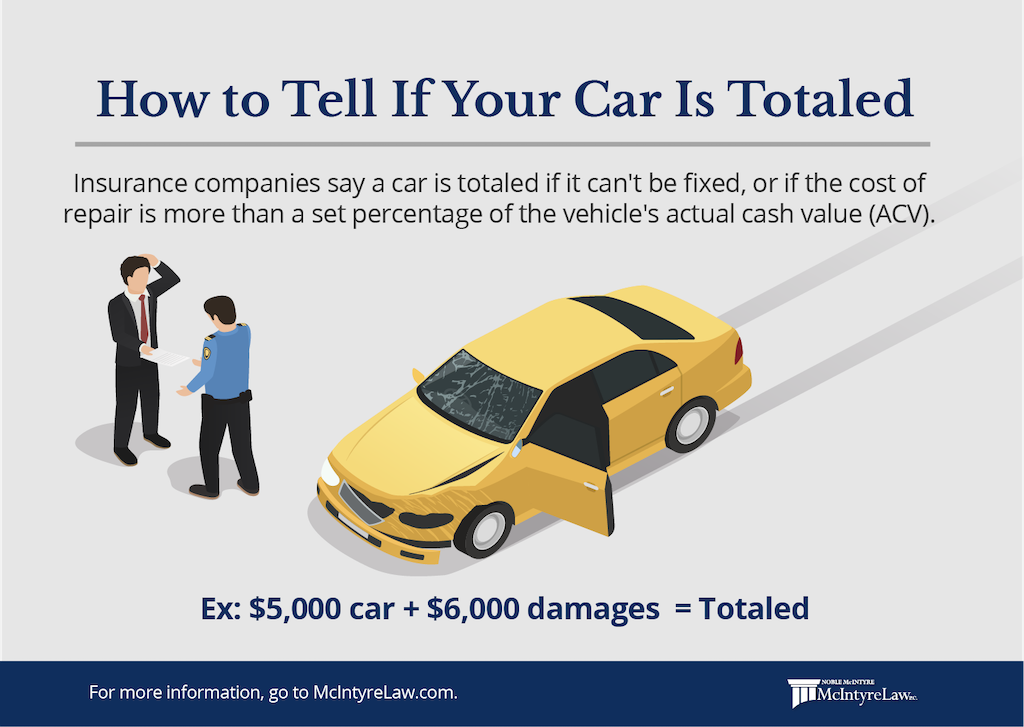

If the car is only worth $1,000 and also the insurance deductible is $500, it may not make sense to buy crash protection. Crash insurance is not typically called for by state law.

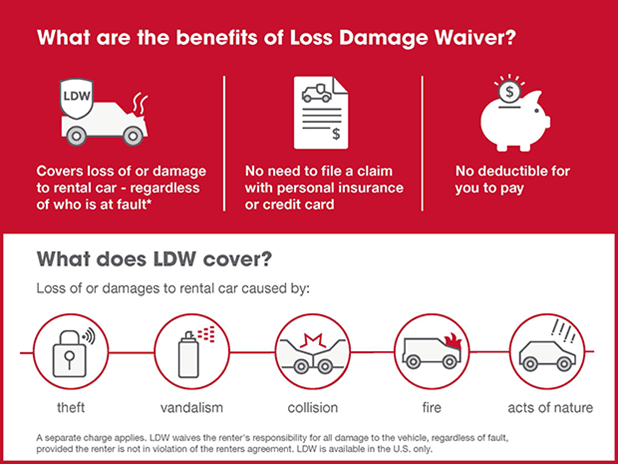

Comprehensive insurance coverage is usually offered together with Accident, as well as both are usually described with each other as Physical Damage protection - insurance affordable. If the automobile is rented or financed, the renting company or loan provider might need you to have Physical Damages coverage, despite the fact that the state legislation might not need it. Covers the cost of treatment for you as well as your travelers in case of an accident.

The restrictions needed and optional restrictions that might be offered are established by state regulation. vehicle insurance. This coverage, needed by legislation in some states, covers your medical costs and also those of your passengers, no matter of that was liable for the crash. The limits called for and optional restrictions that might be available are set by state law.

Choosing the finest auto insurance policy protection, Obtaining the ideal degree of automobile insurance policy is not one size fits all. What is most essential to one cars and truck owner isn't essential for an additional.

low cost automobile vehicle insurance dui

low cost automobile vehicle insurance dui

As well as don't worry if you desire to recognize what the cheapest rates and best security coverages would certainly be, we allow you toggle between the outcomes for both. Just how much auto insurance policy do I need? The cars and truck insurance coverage calculator recommends the right degree of auto insurance coverage for you based on your responses. auto.

About How Much Is Car Insurance? - The Balance

Obligation insurance coverage covers problems you may create others in a vehicle accident. cheaper car insurance. This suggests damages to their car or injuries the various other chauffeur or their travelers may have sustained. It will certainly additionally spend for damages you caused to another person's residential or commercial property, as an example if your beginner teen motorist strikes your neighbor's fencing.

Comprehensive covers your automobile for "apart from collision" occasions like theft, fire as well as damage from weather occasions like flooding and hail. Crash covers, no matter mistake, if your automobile Click here is damaged in an auto crash or if you roll or flip your car by accident - credit score. Compensation and accident are not called for by any state but is funding business if your car has a lease or loan on it - car insured.

vehicle cheap car insurance laws cheapest auto insurance

vehicle cheap car insurance laws cheapest auto insurance

It covers the "space" left when your insurance coverage payout is not sufficient to cover the reward on your auto. Spending for this additional coverage is far better than advancing paying on an automobile that you no more automobile drive. If you enroll in void insurance policy, your insurer will certainly determine how underwater you are with your lorry value and also establish just how much the policy would certainly pay out.

You place your injury claims with your very own insurance provider first in no-fault states. Just how much PIP you need to bring will be determined by state mandates.Uninsured/ Underinsured motorist is required in some states as a method to cover injuries you suffer in a car accident if the at-fault event was uninsured or underinsured. If you have a great deal of assets you could lose in a reasoning, an umbrella policy is a means to safeguard them. It is optional protection as well as how much you need relies on your possessions and monetary circumstance. As you go via the automobile insurance policy calculator you will certainly discover the suggested car insurance protections based on your responses. Insurer rating systems vary so depending what coverages, limitations as well as deductibles you pick the firm that is finest for you will differ. It will also differ based on your driving record and various other ranking variables that specify to your existing circumstance. If you intend to estimate your auto insurance policy prices, no worries we can aid you keeping that too. You can after that acquire the policy straight from Insurance - auto. com, proceed to an insurance coverage carrier's site or talk with a licensed insurance policy agent over the phone. You can additionally view prices by age, prices by state as well as prices by firm. With all of these means to estimate as well as compare prices you need to have a great idea of what you should be paying. Exactly how to estimate vehicle insurance coverage prior to purchasing a cars and truck, When you remain in the quest for a brand-new cars and truck( whether it's a brand

brand-new car or simply brand-new to you), it is vital to go shopping about for car insurance coverage prices at the same time. You do not intend to find the ideal cars and truck only to learn you can pay for the car repayments however not the expense to guarantee it. You do not wish to miss out on out on vital protection for your lorry by avoiding a protection. Just how much auto insurance policy do I require? Fantastic inquiry! The brief and very easy response is: We're not saying that simply to drum up company. The fact is, way too many motorists are lured into lowball cars and truck insurance policy prices estimate that are based on state minimums. As well as Massachusetts'needed minimum limitations are frighteningly low, when you take into consideration the real cost of a lot of car crashes (much more on this below). The web site even states:"Provided the high costs connected with major crashes, many drivers get insurance coverage restrictions past the minimum requirements." Below are some truths to help put the numbers into viewpoint: The ordinary auto now costs a little over$31,000. Deluxe cars like Mercedes as well as BMWs set you back a bargain extra. Various other types of residential property(besides cars)can be expensive, also. Consider the different sorts of residential or commercial property that an auto may ram: telephone posts, street lamps, guardrails, mail boxes. Some of these can cost approximately thousands of dollars in damages all by themselves, as a result of the substitute material, tools, and labor involved in a repair work. Comprehensive/collision are optional enhancements you can(as well as ought to) add to your MA auto insurance coverage to cover the cost of damage to your automobile. Collision, as the name would certainly suggest, covers you for damages suffered in a crash occasion. With collision insurance coverage, your policy would pay for problems approximately the real cash worth of the car, minus the insurance deductible that you choose(which you would need to pay out of pocket). And also most of them don't have enough insuranceor any kind of insurance coverage in any way. Make certain you and also your relative are adequately covered. Provide us a call or fill in the fast quote form today. Wondering just how much the expense of vehicle insurance coverage will be for that lovely new automobile you 've been dreaming regarding? You're not the only one. And also landing on that precise number can be tough for a number of factors since insurance policy rates can vary by auto kind and also the age of the automobile. cheapest car.

A lot of vehicle insurance coverage business will have their insurance agents collect information concerning your car when developing a quote. You might be able to save money on automobile insurance coverage with a great

credit rating. The price of your cars and truck and also the year it was created will be used to aid create your insurance rates. suvs.

cheaper auto insurance car insurance credit cars

cheaper auto insurance car insurance credit cars

The area and also postal code where your auto is registered will certainly have an effect on the quantity you spend for insurance policy. Safe communities with reduced criminal activity prices are normally related to lower insurance rates - auto insurance. If you're able to bundle various other plans with your vehicle insurance coverage, you can minimize your premium. With American Family Members Insurance coverage, you might have the ability to save huge. Inspect with your agent for more information about packing. You'll likely be inquired about the means you mean to use your cars and truck when you request automobile insurance policy. You'll be inquired about the range you'll be driving to and also from job each day as well as regarding your projected annual gas mileage. One way you can regulate the cost of your (risks).

Getting The Car Insurance - Get An Auto Insurance Quote - Allstate To Work

auto auto credit cheap

auto auto credit cheap

https://www.youtube.com/embed/aFLb6WaIbNQ

auto insurance policy is to ask for quotes on different insurance coverage limitations. By readjusting these limits and also your insurance deductible, you should be able to locate the insurance coverage you require. Because several states require you to get automobile insurance coverage that protects versus uninsured drivers, you're going to possibly require something near full insurance coverage to accomplish those requirements. If your state doesn't need you to have insurance, including physical injury liability coverage, you might be doing on your own a huge support if you're ever discovered accountable for an accident that caused injuries to others. cars. At American Family, we'll compensate you when you sign up in My Account and select paperless billing. In this article, we'll discover how typical cars and truck insurance policy rates by age and also state can rise and fall. We'll likewise take a look at which of the very best cars and truck insurance policy firms provide excellent price cuts on cars and truck insurance policy by age and also contrast them side-by-side. Whenever you purchase auto insurance, we advise obtaining quotes from multiple providers so you can contrast protection and prices. So why do ordinary cars and truck insurance prices by age differ a lot? Basically, it's all about threat. According to the Centers for Disease Control and Avoidance(CDC), people between the ages of 15 and 19 made up 6. 5 percent of the population in 2017 yet represented 8 percent of the total price of cars and truck crash injuries. The rate information comes from the AAA Foundation for Traffic Safety And Security, and it accounts for any crash that was reported to the authorities. The ordinary costs data originates from the Zebra's State of Vehicle Insurance coverage record. The costs are for plans with 50/100/50 liability insurance coverage restrictions as well as a$500 deductible for comprehensive and also accident insurance coverage. According to the National Freeway Web Traffic Security Management, 85-year-old males are 40 percent more probable to enter a crash than 75-year-old men. Looking at the table over, you can see that there is a straight connection between the accident rate for an age team as well as that age's typical insurance policy costs. Maintain in mind, you could locate much better rates with an additional company that does not have a particular trainee or elderly price cut. * The Hartford is just readily available to participants of the American Association of Retired Folks (AARP). Policyholders can include younger motorists to their plan as well as get discounts. Average Automobile Insurance Policy Fees And Cheapest Service Provider In Each State Since car insurance coverage rates differ so a lot from state to state, the company that uses the most inexpensive auto insurance policy in one state may not use the least expensive insurance coverage in your state. You'll also see the average price of insurance coverage because state to assist you contrast. The table likewise consists of prices for Washington, D.C. These rate approximates use to 35-year-old chauffeurs with great driving documents and also credit. As you can see, average cars and truck insurance coverage costs differ extensively by state. Idahoans pay the least for cars and truck insurance, while motorists in Michigan spend the big dollars for coverage. If you live in midtown Des Moines, your costs will probably be greater than the state average. On the various other hand, if you live in upstate New york city, your vehicle insurance policy will likely set you back much less than the state standard. Within states, vehicle insurance costs can differ commonly city by city. But, the state isn't among one of the most expensive total. Minimum Coverage Requirements Most states have monetary obligation regulations that require drivers to bring minimal auto insurance protection. You can only forego coverage in two states Virginia as well as New Hampshire yet you are still economically liable for the damages that you cause. Some insurance companies might use discounted rates if you do not use your car a lot. Others offer usage-based insurance coverage that might conserve you cash. Insurance providers factor the likelihood of a car being taken or harmed in addition to the expense of that vehicle right into your costs. If your vehicle is one that has a probability of being swiped, you may have to pay more for insurance. Yet in others, having poor credit can create the cost of your insurance costs to increase substantially. Not every state allows insurance providers to utilize the gender noted on your driver's certificate as an establishing aspect in your costs. In ones that do, women vehicle drivers typically pay a little much less for insurance coverage than male motorists.

Facts About Who Pays For My Rental Car After An Accident? - Citywide ... Uncovered

Edit your About page from the Pages tab by clicking the edit button.

The Facts About What Happens If You Have A Car Accident Without Insurance? Uncovered

Edit your About page from the Pages tab by clicking the edit button.

9 Easy Facts About What Happens If A Rental Car Is In An Accident - The Ryan ... Explained

Edit your About page from the Pages tab by clicking the edit button.

The Only Guide for What Happens If You Crash A Rental Car Without Insurance

Edit your About page from the Pages tab by clicking the edit button.

Indicators on How Should I Handle An Auto Accident In A Rental Car? You Should Know

Edit your About page from the Pages tab by clicking the edit button.

The Of Who Pays For The Rental Car After A Car Accident In South ...

Edit your About page from the Pages tab by clicking the edit button.

The Best Guide To Best Car Insurance For Teens And Young Drivers For May 2022

Edit your About page from the Pages tab by clicking the edit button.

The smart Trick of How Much Does Car Insurance Cost? - Lemonade That Nobody is Discussing

Edit your About page from the Pages tab by clicking the edit button.

Little Known Facts About Car Insurance Coverage Calculator - Geico.

Edit your About page from the Pages tab by clicking the edit button.

How Auto Insurance Reform: Hearing Before The Committee On ... can Save You Time, Stress, and Money.

Edit your About page from the Pages tab by clicking the edit button.

The Best Guide To How Much Does Car Insurance Cost, On Average? - Money ...

Edit your About page from the Pages tab by clicking the edit button.

The 4-Minute Rule for How Much Is Car Insurance Monthly In Nj?

Edit your About page from the Pages tab by clicking the edit button.

Why Is My Car Insurance So High? - J.d. Power Can Be Fun For Everyone

The pandemic triggered a change in the world of vehicle insurance coverage. 4 billion in reimbursements, car insurance earnings boosted as fewer Americans drove as well as the number of automobile insurance claims went down.

See what you can save money on auto insurance, Quickly compare tailored rates to see just how much changing automobile insurance can save you. Automobiles are more expensive to buy and repair, Raised need from drivers as well as a semiconductor shortage has made brand-new and used autos more pricey, as well as it's expected to add to a rise in rates this year, according to a research study from Swiss Re Institute, the research-focused division of Swiss Re Group, among the biggest reinsurance business on the planet - risks.

cheapest auto insurance cheapest auto insurance cheapest auto insurance liability

cheapest auto insurance cheapest auto insurance cheapest auto insurance liability

This raised cost methods much more pricey cases for insurance providers, and also cases are currently anticipated to return to pre-pandemic numbers this year. In addition, there's a grease monkey scarcity (cheaper car). There was a sharp decline check here in the number of functioning technicians in 2020, according to a research of automobile specialist supply-and-demand from Tech, Pressure Foundation, a nonprofit that provides resources to hopeful automobile service technicians.

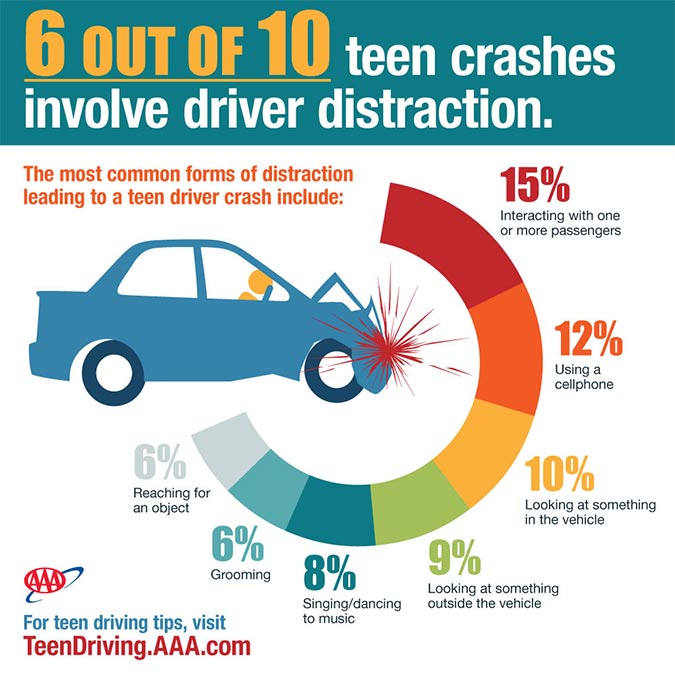

Driving has become much more dangerous, Vehicle accidents triggered by distracted driving have actually gotten on the surge for several years. While phone usage is an usual distraction, motorists are also reading, eating, applying makeup or preoccupied with their kids while behind the wheel. Sidetracked driving triggered 9% of fatal auto accident in 2019, according to the most recent information available from the National Highway Web Traffic Safety Management.

Vehicle drivers appear to also be speeding up even more since the pandemic started, which suggests a higher chance of automobile mishaps. A study of 500 U.S. motorists done by Erie Insurance coverage discovered that a person in 10 drivers claimed they drove much faster than normal at the beginning of the pandemic. As a matter of fact, speeding has become such an issue that campaigns have actually been introduced in Maryland as well as Virginia to create speed-reduction approaches that can be implemented throughout various other states.

How Car Insurance Premiums Rise By £68: How To Save When ... can Save You Time, Stress, and Money.

10 states, including Texas as well as Michigan, saw average decreases of $112 or even more. Of the states that did see rate rises, the typical yearly increase was $83, a little bit even more than 5% over 2020 rates. Meanwhile, the nationwide customer rate index for automobile insurance saw a decrease of 3. cheap insurance.

Significant automobile insurance companies have submitted to enhance rates this year in some states as more chauffeurs are back on the roadway as well as the number of automobile claims is expected to increase. You can still discover less expensive rates, If you do see a cost increase in your car insurance, you have options: Ask about discounts you could be missing.

insurance companies cars cheapest car insurance cheap insurance

insurance companies cars cheapest car insurance cheap insurance

Obtain quotes from various other insurance providers. Shopping around for brand-new auto insurance coverage quotes is typically the most effective method to conserve. Contrast car insurance policy quotes from a minimum of 3 insurance companies as well as choose the most inexpensive rate. Geek, Purse recommends shopping about a minimum of once a year to guarantee you're obtaining the best deal.

Contrasting prices from numerous insurance companies, also after a crash, is still amongst the most effective ways to save money on car insurance coverage. Just how a lot will your vehicle insurance coverage rates enhance after a crash? If you enter into an accident in which you are at mistake and also somebody is hurt, your auto insurance coverage rates can go up $1,157 generally, a rise of 46% (cheaper cars).

Rates just enhanced 47% in those 4 states with a mishap where a physical injury insurance claim was made. It is essential to keep in mind that if you are not located liable for a mishap, your insurance policy rates will likely not rise. However that's not real in all cases, as some business raise prices slightly after that type of case.

About Will My Car Insurance Rates Go Up? - Azlawhelp.org

That's why (vehicle insurance). The very same motorist looking for could be treated very in different ways among various insurance firms. Which firms use the ideal insurance policy rates after a crash? After a crash, your insurance company will have an influence on how much your rates go up. Various insurance companies flaunt different offerings when it pertains to just how they deal with accidents.

Normally, accident mercy is either an add-on that prices extra or a perk offered after multiple years often 5 or more with a clean driving record. For instance, State Farm's crash mercy enters into effect after nine years without a crash. Across 5 of the largest insurers, State Farm had the smallest rate increase, 24%, after a crash that caused a physical injury claim.

When a crash could not enhance vehicle insurance policy rates Defining what isn't a crash is a lot more difficult than specifying what is - cheaper cars. Yet the majority of insurance provider in a crash. Some insurance providers inspect whether the insurance holder is at least 50% to blame. If you do not satisfy this threshold, then your insurer usually won't raise your rates.

Compensated by, or on part of, an individual liable for the mishap (auto insurance). Rear-ended and also not founded guilty of a moving web traffic violation in link with the accident.

Not convicted of a relocating web traffic offense in link with the crash, yet the various other vehicle driver is. If you were involved in a crash five years ago, it generally won't be thought about when determining your rates.

Little Known Facts About How Claims Affect Your Insurance Rate - I Drive Safely.

cheap auto insurance cheap money perks

cheap auto insurance cheap money perks

Your rates are computed based upon a variety of variables, as well as you can do a few things to boost your profile. affordable car insurance. Insurance firms supply a, consisting of discount rates forever trainees, for having several policies and permanently driving tracked by an app. Talk to your insurer for your alternatives.

Not all states variable in for insurance prices, yet numerous do. Paying off financial debts, not missing payments and resolving any problems on your credit score record can all help reduced prices.

Just how much insurance coverage prices go up after an insurance claim might differ based upon your driving document and also the extent of the accident - vehicle insurance. How much time does an accident impact your insurance? Insurance companies most usually concentrate on the previous three years of your driving document when establishing prices. A crash generally affects rates for a minimum of that long, though some insurance firms consider an at-fault crash for as much as five years or longer in uncommon cases.

Exactly how can drivers save on vehicle insurance in 2022? The price of insuring an electrical lorry is anticipated to go down, as well as more Americans are expected to take benefit of usage-based insurance coverage programs, which award good driving with reduced rates.

By debenture a larger share in the occasion of a case, your insurance policy firm will certainly be ready to approve a reduced premium. Examine your existing insurance coverage and also see if there is anything you no longer demand, or take into consideration packing your cars and truck insurance policy with your house insurance to save on both.

3 Simple Techniques For How Car Insurance Premiums Are Calculated

laws cheap auto insurance insurance company car

laws cheap auto insurance insurance company car

Our rapid as well as safe application will certainly reveal you the finest available prices from 50+ service providers, conserving you time and also money when going shopping for your following plan.

Find out just how much insurance increases after a crash for different kinds of drivers in 2022., Vehicle Insurance Coverage Author, Jan 20, 2022.

It prevails for insurance providers to raise cars and truck insurance policy rates after you have actually remained in a crash, filed a case due to the fact that a tree arrived on your automobile, or had a regrettable altercation with a deer. Occasionally rates can boost without caution. The insurance coverage company may elevate your prices for many factors, and also a few of them have nothing to do with your driving document or claims background.

Automobile insurance assists pay for points like accident-related medical costs, residential or commercial property damages, as well as legal actions. It might likewise aid pay for lost incomes and funeral expenditures, depending on what state you reside in. As a whole, there are six primary kinds of insurance coverage for auto insurance coverage plans. If you're liable for hurting someone in a car crash, this protection helps pay the medical expenses of the motorist and guests in the other car (insurance).

Comprehensive pays the fixing or substitute costs if your lorry is harmed by a range of incidents, consisting of hail storm, earthquakes, hurricanes, theft, vandalism, as well as much more. Not everybody has insurance coverage, even though it's the legislation in most states. If an uninsured or underinsured vehicle driver strikes you, this insurance coverage begins to help cover the expense of fixings and clinical costs.

Some Known Details About What Causes Your Insurance Premium To Go Up?

Others are optional, as well as it differs by state. Nonetheless, if you skip optional insurance coverage where you live, you might not be covered if the unforeseen takes place. You possibly wouldn't be stunned if your costs boosted after a crash. However also if you have a tidy driving document, the insurer may still raise your cars and truck insurance prices, and there could be lots of reasons that.

As an insurance provider's cost of doing business boosts across the board, they may raise your premium to assist offset their expenditures. It's not uncommon for insurance firms to increase car insurance policy rates if there's been an uptick in severe weather occasions or the number of mishaps in your location. Both boost the probability that the insurer will have to pay out a case - car.

Insurer use many different elements to identify cars and truck insurance rates, as well as the requirements they use might vary from one insurance firm to an additional. While a rate rise possibly isn't welcome information for any individual, numerous of the variables insurance providers use to establish premiums remain within your control. Motorists without accidents, speeding tickets, or various other moving infractions on their record stand for much less of a risk to insurers as well as typically get lower rates than individuals with a spotty driving record. cheapest auto insurance.

Insurance policy business take into consideration more youthful and older motorists to be a higher risk, and their costs reflect that since stats show they tend to enter more mishaps. The much less experience you have, the higher your premium can be. cheapest car. Some locations have higher rates of theft, criminal damage, and also accidents. If you reside in a location where the insurance provider is most likely to pay out a claim for among these occurrences, your price will commonly be greater.

Be sure to ask your insurance provider regarding the discounts they provide. If you do not put a whole lot of miles on your vehicle, you might be able to save cash with a pay-per-mile plan instead of a traditional automobile insurance plan.

Car Insurance Rates Are Increasing, So Shop Around To Save Things To Know Before You Buy

Some of the changes you make in your life can affect the cost you pay for vehicle insurance policy. If you move to an area where just a couple of individuals get right into crashes and also not many cars are taken, there's a good chance your auto insurance rate will go down (assuming whatever else in your life remains the same).

https://www.youtube.com/embed/6d5eAxI4z3w

If you move to a different state, that's more difficult to forecast. Each state controls insurance differently, and the difference in expense can vary extensively.

Some Ideas on How Much Is Car Insurance For A 16 Year Old? You Should Know

Generally Asked Inquiries Concerning Vehicle Insurance Policy A.

The highest insurance policy rates are paid by any male driver under the age of 25 (insurers). His price after that hinges on whether he's wedded as well as whether he owns or is the main driver of the vehicle being guaranteed. With the increase in young women vehicle drivers in the last twenty years, nonetheless, the mishap prices in between the sexes are night out.

No. However, you must have a legitimate chauffeur's permit. Also, in numerous states, you should be 18 before you can have a vehicle without an adult's name on the car registration. A. Vehicle insurance plan typically last six months. Some last one year. You will certainly get a notice when it's time to restore your insurance policy.

A. Under many situations, a person using your vehicle with your authorization is covered by your insurance. If the individual obtains your cars and truck with your permission and is entailed in a mishap, your insurance will pay as if you were the chauffeur. Nonetheless, in some states, some insurers might limit the coverage.

In this example, a young chauffeur might see the price of their insurance greater than double after one ticket and also one accident - auto. Simply to emphasize, the business utilized far better than average protection for our price examples, not barebones protection, so they are not the business's cheapest Find more information prices. All are based on the teen driving a 2003 Honda, normal usage.

How Much Is Car Insurance For A 16 Year Old? Fundamentals Explained

low cost cheaper auto insurance insurance perks

low cost cheaper auto insurance insurance perks

If you have an older car with low market price, it might be an excellent suggestion to lower your premium by getting rid of accident insurance coverage (risks). When you offer your automobile to a person and they trigger an accident, it is their cars and truck insurance coverage that will certainly cover the problems on your car.

low cost auto car insurance cheap car insurance money

low cost auto car insurance cheap car insurance money

The age and sex of a chauffeur are 2 critical elements when determining the costs, which is the price of vehicle insurance policy. Your place, the automobile you own, and your driving background additionally influence car insurance premiums. Your age can just offer you a rough idea of whether your costs might be higher or lower.

cheap car affordable cheap car insured car

cheap car affordable cheap car insured car

At what age does car insurance go down in expense?

Typically, the age variety of 26-69 may be seen as the golden period in which car insurance coverage prices lower with age. You ought to bear in mind that this may not hold true for everybody because age group, as there may be various other reasons for billing the motorist a higher premium. If you're wondering what age cars and truck insurance coverage drops for male motorists, the solution is commonly 25.

Likewise, senior citizens might need to pass numerous medical examinations prior to they can renew their driving certificate, which includes an extra danger from an insurer's viewpoint - cheap. These threats translate right into senior citizens needing to pay more for automobile insurance policy. However, senior citizens may get approved for lower premiums if they concur to particular problems such as driving only during daytime hrs or remaining off freeways when driving.

How 2022 Car Insurance Rates By Age And Gender - Nerdwallet can Save You Time, Stress, and Money.

This sort of plan appropriates for senior citizens who just expect to drive when definitely needed or from time to time. Yet both conventional insurance plan in addition to 'pay as you drive' plans can need senior citizens to pay a greater automobile insurance excess, which lowers the insurance company's share of the payment to be paid in instance of a crash. car.

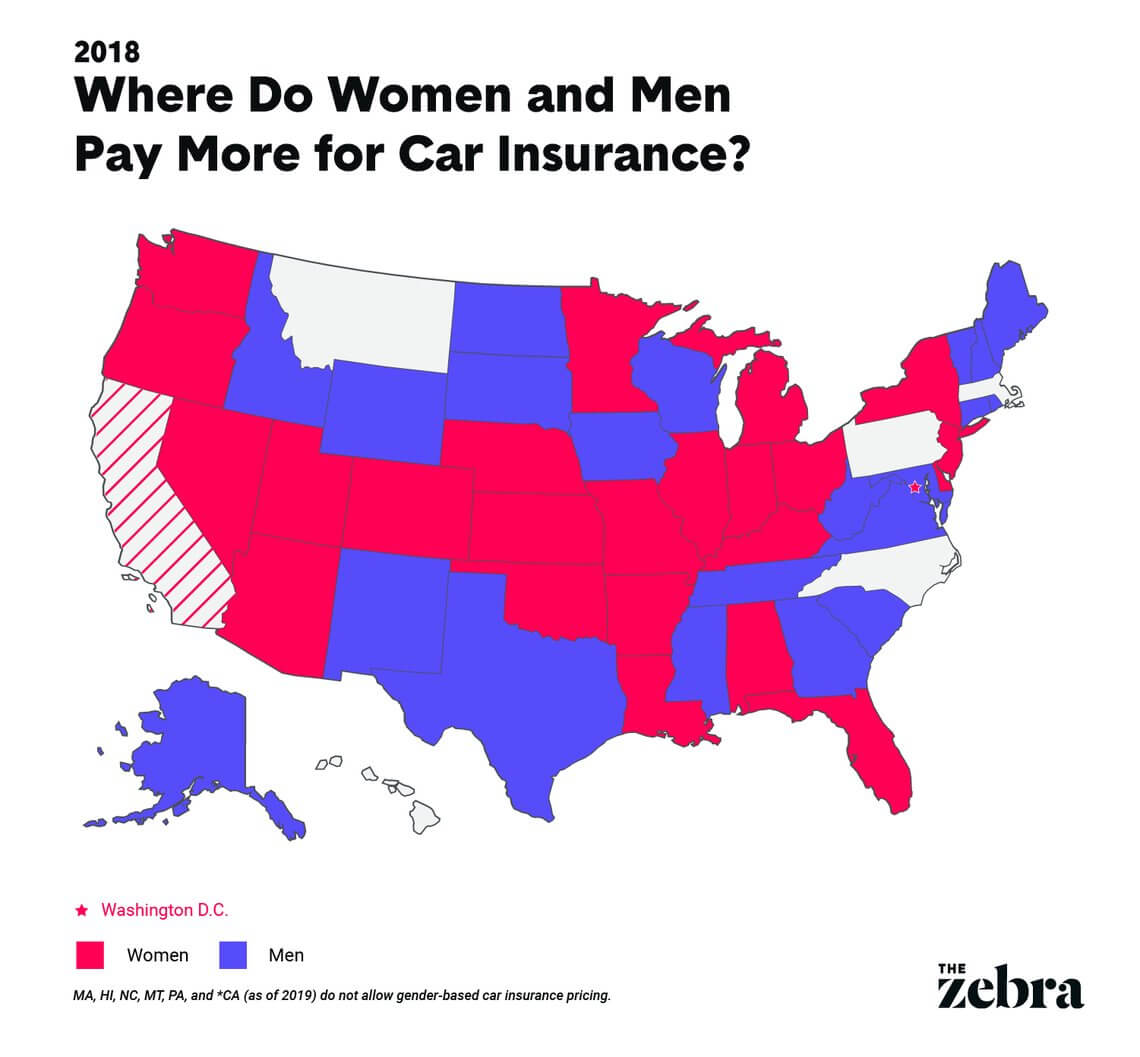

When establishing which gender pays much more for auto insurance, insurance provider check out numerous historic factors, such as the tendency of male chauffeurs to enter more accidents. Nonetheless, gender is not the only consideration that's made when policy prices are being calculated. credit. Insurance provider also look at a driver's age as well as typical elements such as driving background, credit rating, as well as safety attributes on the lorry.

Considering that ladies are less likely to be in a crash than men which males are more probable to drive without their seat belt, it may amaze vehicle drivers to find out that, generally, women pay even more for automobile insurance coverage than their male equivalents. According to The Zebra, ladies pay $740 for their six-month costs versus guys who can anticipate to pay a standard of $735 for 6 months.

Despite their sex, more youthful chauffeurs will certainly pay more for their automobile insurance costs than any kind of various other demographic, according to Huff, Blog post (car insurance). The reason young motorists experience high prices is that, as a population, they are most likely to be risky chauffeurs by speeding, neglecting to use their seat belt, and breaking various other driving regulations.

Despite the fact that women pay even more for their cars and truck insurance coverage premiums generally, at much less than 1 percent over what males pay, this is turned around when comparing young motorists. Per The Zebra, a young man will certainly pay around 14 percent much more for their premium than their female equivalents. This is because of the threats male drivers under 20 take when driving.

The 5-Second Trick For Car Insurance: Why Women Face £300 Rise In Premiums - The ...

When a chauffeur turns 25, nonetheless, their auto insurance rates generally lower, and also men as well as females with the same driving record can anticipate to pay almost the same. females pay slightly greater than men by less than 1 percent, according to Insurance policy Journal (vehicle insurance). After the price decline at 25 years old, vehicle drivers can generally expect to maintain around the same rate of insurance coverage till they get to the age of 60 when there is another significant drop.

Also if a wedded vehicle driver is young, their marriage status saves them around 21 percent versus their solitary counterparts. The distinction is also more noticable when compared to wedded as well as solitary womena young, single woman can expect to pay 28 percent even more than her wedded women close friends.

All chauffeurs in Michigan can expect to pay more than in various other states, according to Car and also Chauffeur, even prior to thinking about the age and sex of a policyholder (cheapest auto insurance). Various Other Ways to Reduce Insurance, Fortunately, there are methods to conserve on car insurance coverage, also if a driver comes under the team with the highest prices.

According to The Zebra, an at-fault accident will create insurance coverage prices to boost by 42 percent usually, plus the infraction stays on a driving document for 3 years, after which the rates will return down as long as there aren't any type of various other infractions. Some drivers assume that they must submit claims for every mishap, but that's not always the case.

In-Car Gadgets, There are some insurer that more carefully monitor the means a chauffeur operates their lorry by installing a gadget that will certainly give analyses based upon braking behaviors, rate, and also time of day the automobile is operating. low cost. According to esurance, these telematics readings help when determining rates.

Not known Details About How Age And Gender Affect Car Insurance Rates - Forbes

For lorries worth even more than $4000, chauffeurs might want to raise their deductible instead than removing important insurance coverage., as well as vehicle drivers will certainly desire to inspect with their insurance policy representative to establish what they qualify for.

Despite the fact that one's gender contributes in a motorist's insurance coverage rates, studies show that the distinction is most evident when considering young vehicle drivers - cheap. Apart from the early years when motorists are young and brand-new at running a lorry, insurance business look mainly at driving document, credit rating, marriage condition, and offered discounts when determining plan prices.

You might be able to discover more details about this and also comparable web content at - business insurance.

Having a teen driver can obtain costly, rapidly. Moms and dads as well as guardians need to take the time to chat to teen chauffeurs about the severity of driving safely.

They included a 16-year old teenager to the plan. This is what they saw take place to the rates: The average home's vehicle insurance coverage bill climbed 152%.

The Clearing The Air: How Does Your Gender Factor Into Your Car ... PDFs

business insurance auto suvs auto insurance

business insurance auto suvs auto insurance

According to the short article, the reason behind the boost was because "teens accident at a much higher rate than older chauffeurs. The threat is 4 times as much - liability. According to the federal Centers for Disease Control and Prevention, the worst age for accidents is 16. They have a crash rate twice as high as drivers that are 18- as well as 19-year-olds." So, insurance provider have to plan for that expected sustained price of guaranteeing the driver.

Typically, auto insurance policy business won't connect what discounts they use to teen motorists unless you ask. low cost auto. Do your research and know what is offered to you. To get you began, right here are some of the finest discount rates for teen chauffeurs that will aid you get automobile insurance coverage that you can afford.

Not all of these price cuts can be made use of at the exact same time or incorporated with each other. Make sure you completely recognize what is and isn't accepted by your insurance coverage service provider. Excellent Trainee Discount: Basically, if your teen shows excellent qualities and also obligation in school, they obtain a break on the cost of cars and truck insurance coverage.

Trainee Away Price Cut: If your teen is away for school as well as not driving, ask your provider regarding an "away" discount rate. This can conserve you around 5% -10% - cheaper car. Elevate Your Insurance deductible: This simply implies you raise the quantity that you are liable for covering in the occasion of a crash as well as is a very easy method to lower car insurance coverage costs.

Make certain to ask your representative regarding the moment periods and also when this becomes offered to the motorist. Excellent driving practices are crucial to maintaining insurance coverage costs reduced and cost effective. It is also essential in maintaining your teen and also others when traveling secure. Be sure to speak to your teenager concerning safe driving behaviors and be certain you model those risk-free driving habits to them.

Getting My What Is The Average Cost Of Car Insurance? - Money Helper To Work

982 individuals passed away in website traffic crashes on our state roads in 2017. That corresponds to one death every nine hours.

2022 I Drive Safely We Develop Safer Drivers (car).

Other things that may be considered include for how long you have actually been driving, your driving document, and your claims history. Why Rates and also Quotes May Differ To aid guarantee you obtain a precise quote, it is necessary to offer total and accurate information. Imprecise or incomplete info can cause the quote amount to differ from the real rate for the plan.

https://www.youtube.com/embed/HhFLp2NFHsg

If you omit details in the quoting procedure regarding mishaps you've remained in (also minor ones), your plan rate might be greater. If you fail to remember to supply information concerning your significant others' driving history, such as speeding tickets, this might cause a higher rate. Ensuring you have the best details can make the process of getting a quote less complicated.

Deductible In Car Insurance Policy - Icici Lombard Can Be Fun For Everyone

If you go also high, it can be monetarily ruining if you have to submit an insurance claim. To assist you make the appropriate selection for you, here are some things to consider:: A huge reserve might enable you to pay for a large deductible, which could aid you reduce month-to-month insurance policy prices - cheapest auto insurance.

: If you've funded your lorry, your lender may require certain sorts of insurance coverage as well as limitations on deductible quantities. While you might be able to manage a higher deductible, your lender may not permit it. cheaper car.: If you've obtained in numerous accidents in the current past, you could be at a greater risk of obtaining in another one, and also a lower deductible may be a far better alternative.

There's no one-size-fits-all remedy for everyone, so it is necessary to think about these variables as well as various other elements of your scenario to choose the appropriate insurance deductible for you. Other Ways to Conserve on Cars And Truck Insurance Coverage, Selecting the appropriate insurance deductible can provide you an excellent equilibrium in between saving on your monthly price and the quantity you owe when you file a case. insure.

Other means to save money on car insurance policy include: Buying around and comparing quotes from several insurance providers, Applying price cuts that you get approved for, Making adjustments to insurance coverage amounts, Improving your debt rating, Insurance provider in most states utilize your credit record to produce what's called a credit-based insurance coverage score (insurance companies). They after that use this score to assist determine your price.

$500 Or $1000 Auto Insurance Deductible? - Policy Advice Things To Know Before You Buy

An automobile insurance deductible is the amount an insurance holder is liable for paying when making an insurance claim with their auto insurer after a covered incident. This has to occur before insurance pays the expenses of problems. For instance, if an automobile incurs $5,000 well worth of damage in a covered crash as well as the chauffeur has a $1,000 deductible, they would certainly pay $1,000 of the repair service expenses and the insurance provider would certainly pay $4,000 - insurers.

The driver would merely pay their deductible. When you do not need to pay a car insurance deductible, There are certain circumstances when individuals do not have to pay a cars and truck insurance coverage deductible. If an additional driver here triggers an accident as well as their insurance coverage pays In a lot of states, a motorist who is in charge of causing a collision is obliged to pay for all damages related to the accident.

If a person's very own lorry is additionally harmed in the very same case as well as they desire to make an insurance claim for repair work under their accident insurance coverage, their deductible will use. If the certain kind of damages does not need paying an insurance deductible Sometimes, specific losses are covered without an insurance deductible.

If someone selected no deductible when buying coverage Insurance companies may allow individuals to select coverage with a $0 deductible - insurers. If someone has no deductible, they won't owe anything out of pocket when a covered incident happens. Remember, though, the cost of vehicle insurance will certainly be greater if somebody picked a no-deductible plan.

Some Known Facts About How Much Car Insurance Do I Need? - Ramseysolutions.com.

Commonly, vehicle drivers require to pick a deductible for comprehensive coverage, accident protection, and also individual injury security. car insurance. What's the typical car insurance policy deductible? The ordinary automobile insurance deductible is $500. People can select an insurance deductible amount anywhere from $0 to $2,000 with a lot of insurance providers. Just how much of an insurance deductible should I select for my cars and truck insurance coverage? The goal when getting an automobile insurance policy quote is to get top quality and also cost effective insurance coverage.

Below are some vital considerations. Danger tolerance, When selecting a plan with a higher deductible, individuals take a larger threat. They're gambling that they won't require to make a claim and also pay out-of-pocket expenses. Those who aren't comfy taking that opportunity may wish to pay greater costs to pass more of the threat of financial loss on to their insurance policy supplier.

Those who often tend to have actually little cash money saved for unforeseen expenses may wish to choose a lower insurance deductible. Individuals with a large emergency fund can probably afford to take an opportunity of sustaining higher out-of-pocket prices if they make an insurance policy case. The possibility of a case, The most likely it is a person will make a claim, the lower they need to set their insurance deductible.

cheaper car perks suvs cheap

cheaper car perks suvs cheap

If the possibilities of a protected incident are unlikely, a vehicle driver may be better off maintaining their costs reduced. Some people could conserve around $220 annually on comprehensive and collision coverage by switching over from a plan with a $50 deductible to one with a $250 deductible. By putting the premium financial savings into a savings account, a person can have enough money in around a year to cover the included deductible quantity.

The Best Strategy To Use For Car Insurance Deductibles

As long as a vehicle driver doesn't obtain right into an accident in much less than a year, they 'd be much better off. The worth of the vehicle, If a car isn't worth much, it may not pay to have coverage with a high deductible. State a driver goes with accident protection with a $1,000 insurance deductible and their automobile is just worth $1,000.

In this instance, the driver would be much better off giving up crash coverage totally. Just how to prevent paying a cars and truck insurance coverage deductible, The ideal means to stay clear of paying an automobile insurance deductible is to avoid crashes, burglary, or damages. Technique defensive driving, adhere to the customary practices, obey the speed limit, and avoid driving in bad weather.

Individuals can additionally pick a policy with no deductible, albeit at a higher expense. Or they can enroll in a vanishing or vanishing deductible with insurers that supply it. This will lower the quantity of the insurance deductible by a set amount during each period the vehicle driver is devoid of mishaps. cheaper car insurance.

auto insurance credit score car vehicle insurance

auto insurance credit score car vehicle insurance

Allow's say you just entered a wreck and also your automobile needs $4,000 out of commission, however your insurance will only cover $3,000. If you're confused, understanding your automobile insurance deductible could be the solution. cheaper car. In this write-up, we'll explain what a vehicle insurance coverage deductible actually is, when you need to pay it, and also whether you must select a high or low one.

Little Known Questions About What Is A Car Insurance Deductible? - Kelley Blue Book.

You don't really pay an insurance deductible to the insurance provider you pay it to the service center when they repair your automobile. Relying on your state, you could have an insurance deductible for various other sorts of insurance coverage, too. Allow's say you submit an insurance claim that results in a $2,000 cost. If you have a $500 insurance deductible, you must pay that quantity prior to the insurer pays the continuing to be $1,500 - accident.

liability insured car vehicle insurance company

liability insured car vehicle insurance company

Insurers will not be accountable for expenditures that do not exceed your insurance deductible. Your vehicle insurance deductible does not function like your health insurance deductible - liability. With health insurance policy, you have a deductible that obtains reset annually. As you make use of health and wellness solutions, the cash you spend out of your very own pocket will add up.

When the brand-new year rolls about, all of it beginnings over. With vehicle insurance, you pay your insurance deductible every single time you sue. Let's state you entered a mishap and also filed a collision claim. On your method to the service center, a fanatic hailstorm storm includes more damage to your auto.

There is no restriction to how numerous times you pay your insurance deductible in a year. How Do Vehicle Insurance Policy Deductibles Job?

The Ultimate Guide To Everything You Need To Know About Your Auto Insurance ...

For instance, if you live in an area with frequent negative climate, you may wish to choose a reduced detailed deductible to limit what you pay out of pocket. At the very same time, you can maintain your collision insurance deductible higher to stabilize out your automobile insurance costs. Kinds Of Insurance Policy Insurance Coverages With Deductibles Below are the common types of car insurance coverage, with details on what they cover and whether they call for an insurance deductible or otherwise.

Because instance, your cars and truck insurance premium would set you back more to offset the $0 cars and truck insurance deductible. When Do You Pay An Automobile Insurance Policy Deductible? Here are the primary circumstances in which you 'd be accountable for paying a deductible: If you create a car accident and also your auto needs repair services, you'll pay your deductible on your collision protection.

How To Select A Cars And Truck Insurance Coverage Deductible Currently that you know what a cars and truck insurance deductible is, it is necessary to select the right insurance deductible for your scenario. You must select a high auto insurance policy deductible if you wish to decrease your month-to-month bill as well as if you have the capability to pay it.

If you do not have any financial savings, it's not a wise idea to have a high deductible. vehicle. You may be the ideal driver in the world, however you still share the roadway with poor chauffeurs and also without insurance motorists. According to the Insurance Policy Details Institute, concerning 6 percent of drivers that had accident protection sued in 2018.

Top Guidelines Of What Is A Car Insurance Deductible? - Youtube

You can constantly select a lower deductible while you save up an emergency fund and also after that increase the insurance deductible later on. auto. You must select a reduced car insurance deductible if you do not have the capability to pay a high one, or if you wish to protect your out-of-pocket prices. A reduced insurance deductible might be a good concept if you live in a congested location where you have a higher opportunity of experiencing a mishap.

affordable auto insurance trucks perks cheap insurance

affordable auto insurance trucks perks cheap insurance

Some programs will certainly reset your insurance deductible to the complete amount after you make a case, as well as others will reset it to a smaller quantity. After 5 years, you would certainly have paid an added $100 or even more to your insurance coverage business.

What Takes place If You Can Not Pay Your Deductible? When paying out an insurance case, your insurance firm will certainly commonly create you a check for the quantity it is accountable for covering. If you are unable to pay the rest of your prices for the deductible, you may have some alternatives. Below are some actions you can take if you can't manage to pay your deductible: It might be rewarding to speak to your mechanic regarding payment alternatives after a crash.

Understanding when to readjust your deductible and when to go shopping around for a brand-new cars and truck insurer with budget-friendly rates is the safest means to avoid high expenditures in the future (insurance). Our Recommendations For Automobile Insurance Searching for auto insurance coverage does not need to be challenging. Just make certain to obtain quotes from numerous service providers, so you can compare rates.

How Michigan's Auto Insurance Law Has Changed can Save You Time, Stress, and Money.

Myth # 1: Red cars are the most pricey to guarantee (cheap car). A red cars and truck won't cost you greater than a green, yellow, black, or blue auto. Insurance firms are interested in the year, make, version, physique, engine size, as well as age of your vehicle. Misconception # 2: My insurance policy will cover me if my vehicle is swiped, vandalized, or damaged by hailstorm or fire.

Comprehensive protection spends for damages to your auto that is not the outcome of an auto accident. Misconception # 3: If my automobile is amounted to, my insurance coverage will certainly pay off what I owe on my car loan or lease. It will only pay you the real cash value of your car, minus your deductible, factoring in depreciation.

Myth # 4: If somebody else drives my auto as well as obtains into an accident, their automobile insurance policy will cover them, not mine. In a lot of states, the vehicle owner's insurance policy should pay for damages triggered by an accident. Obtain accustomed to the legislations in your state prior to enabling another person to drive your auto.

If you're an existing consumer, call us to get enrolled. auto insurance. If you're brand-new here, obtain an automobile quote online in under 5 minutes.

How Deductible - Direct Auto Insurance can Save You Time, Stress, and Money.

affordable auto insurance auto dui insure

affordable auto insurance auto dui insure

https://www.youtube.com/embed/q2yBsT-wdyA

If you've currently experienced a claim, you've most likely discovered just how your deductible jobs very first hand. For those who haven't, it can cause confusion around just what an insurance deductible is and who pays for it. What an insurance deductible is A deductible is the amount of money you (the named insured on the policy) pays out of pocket for the price of problems before the insurance business pays - affordable auto insurance.

How Average Car Insurance Cost For 17-year-olds - Insuraviz can Save You Time, Stress, and Money.

If you don't have ridesharing insurance as well as you're in a mishap, you could be responsible for all the damages-your personal insurance policy likely will not cover you. Just How University Students Can Get

A Discount On Discount Rate InsuranceAuto Insurance Policy of the hardest parts about components regarding insurance cars and truck insurance coverage choices the discounts that price cuts available to readily available. automobile. Is Switching Over Vehicle Insurance Well Worth It?

Another point that can make switching cars and truck insurance coverage worth it is combining it with renters insurance coverage. If you obtain a car insurance coverage as well as occupants insurance policy at.

affordable auto insurance cheap car insurance prices insurance affordable

affordable auto insurance cheap car insurance prices insurance affordable

the same companyExact same business renters insurance occupants be free(complimentary you can view it see a significant discount considerable your car insurance). Average Auto Insurance In Ontario By Month, Age As Well As Gender Wondering how much your auto insurance will cost in Ontario?

Once you get to a specific age, you could see prices begin enhancing again. They tend to drive much more, are most likely to be involved in mishaps, as well as take part in riskier driving practices. Males pay greater than females. To illustrate this factor we sourced data from our quoter as well as contrasted men as well as ladies in a collection of age classifications (insure). We then contrasted them to the overall standard for all drivers. People with a G2 licence will certainly pay greater than an individual with a G licence. As you advance via the licensing system, the quantity will lower. Bear in mind that G1 vehicle drivers can not be listed as the primary vehicle driver on a policy. However a policy with a G1 vehicle driver noted will cause a rate boost. This can be pricey since you are not completely certified.

Statistically, you are a better risk to entering a crash or suing. To save cash, you can get detailed on a moms and dads or guardians plan as a periodic vehicle driver. It will increase the costs, however not as high as if you got a different plan.

No-fault states include: What Various other Variables Influence Vehicle Insurance Coverage Fees? Your age and also your house state aren't the only things that affect your rates. Insurance providers make use of a selection of factors to establish the price of your premiums. Right here are several of the most crucial ones: If you have a tidy driving record, you'll discover a lot better prices than if you've had any recent accidents or web traffic infractions like speeding tickets.

Not known Details About Safeco Insurance - Quote Car Insurance, Home Insurance ...

Others supply usage-based insurance coverage that might conserve you cash. If your cars and truck is one that has a chance of being taken, you might have to pay even more for insurance policy.

However in others, having poor credit report can cause the cost of your insurance costs to increase dramatically. Not every state allows insurance companies to use the gender listed on your vehicle driver's permit as an establishing consider your costs. Yet in ones that do, female motorists generally pay a little less for insurance coverage than male chauffeurs (auto).

Policies that just satisfy state minimum insurance coverage needs will be the most inexpensive. Added insurance coverage will cost even more. Why Do Automobile Insurance Policy Rates Change? Checking out average car insurance policy prices by age and state makes you ask yourself, what else affects rates? The solution is that car insurance coverage prices can change for numerous factors.

An at-fault mishap can increase your rate as high as half over the following 3 years. If you were convicted of a DUI or perpetrated a hit-and-run, your rates will certainly go up much more. Nevertheless, you do not need to remain in an accident to experience rising prices. In general, vehicle insurance often tends to obtain more pricey as time goes on - car insured.

There are a number of other discounts that you could be able to capitalize on right now. Below are a few of them: Numerous firms provide you the most significant price cut for having a great driving history. Additionally called packing, you can get lower prices for holding more than one insurance policy with the same business.

House owner: If you have a home, you might obtain a house owner discount from a variety of carriers. Get a discount for sticking to the same firm for numerous years. Below's a key: You can always compare prices each term to see if you're getting the most effective rate, despite having your commitment price cut.

Tesla Says It Can Lower Insurance Costs & Make Driving Safer - Truths

Nonetheless, some can also elevate your prices if it ends up you're not a good vehicle driver. Some firms give you a price cut for having a good credit report. When searching for a quote, it's a good concept to call the insurance firm and also ask if there are anymore price cuts that relate to you.

Typically, the cost for a full-coverage plan can set you back from $1300 in Maine to $8700 in Michigan. It can likewise vary within a state according to run the risk of variables in particular places. If you live or keep your cars and truck in an area that is regarded "high risk," whether it is because of regular collisions, criminal activity, or weather condition conditions, you might have a higher insurance policy price than a motorist with a comparable profile in a different location - vehicle insurance.

Minimum protection is the least costly plan you can get for your cars and truck, however it only covers the minimal demands by legislation from the state. With full insurance coverage, you have comprehensive as well as collision insurance coverage in enhancement to the minimum coverage. This option is much more pricey, it comes with more protection for your automobile.

Age is utilized to indicate just how much risk a motorist is to the insurer. Youthful or inexperienced vehicle drivers are a higher threat for the insurer, which is why they have higher insurance costs. As soon as vehicle drivers are 30 or older, automobile insurance coverage premiums are affected by sex - cheap. Young male motorists may have a premium that's 10 percent more than that of a young female driver.

In the states that enable gender-based prices, the distinction in premiums in between men and females is much less than 1 percent. The six-month typical vehicle insurance coverage premiums by gender are: Male: $734.

car trucks affordable car insurance

car trucks affordable car insurance

No-fault states include: What Other Elements Influence Automobile Insurance Policy Rates? Your age as well as your house state aren't the only points that impact your rates. Insurance companies utilize a range of factors to establish the price of your costs. Here are some of one of the most vital ones: If you have a tidy driving record, you'll discover far better rates than if you've had any kind of recent accidents or website traffic offenses like speeding tickets.

The Single Strategy To Use For Average Car Insurance Rates By Age And State (May 2022)

Some insurance firms might provide reduced rates if you don't use your auto a lot. Others supply usage-based insurance policy that may conserve you cash. Insurers factor the likelihood of a lorry being swiped or harmed in addition to the expense of that vehicle right into your costs. If your auto is one that has a likelihood of being taken, you may need to pay even more for insurance.

cheapest cheap insurance insurance company cheaper car insurance